Average tax return for single

How much does a single. Nearly 2402 million returns were filed in 2021.

Paying Too Much Taxes My Belgian Pay Slip Explained Social Security Office Holiday Pay Group Insurance

The Federal Income Tax calculation includes Standard deductions and Personal Income Tax Rates and.

. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Web The table below details how Federal Income Tax is calculated in 2022. Web For the 2020 filing season which covers returns filed for the 2019 calendar year the average federal tax refund for individuals was 2707.

The average tax refund. Web Enter the number of children included in line 2 that are under age 17. If you make 80000 a year living in the region of California USA you will be taxed 21763.

Web What is the average tax return for a single person making 80000. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Web Your average tax rate is 228 and your marginal tax rate is 396.

Be Prepared When You Start Filing With TurboTax. Web 50 rows For the 2020 filing season which covers returns filed for the 2019 calendar year the average. Number of children without health.

Number of adults without health care coverage. A Simple Step-By-Step Process To Help Guide You Through Calculating Your Taxes. The Federal Income Tax calculation includes Standard deductions and Personal Income Tax Rates and.

Web For the 2020 filing season which covers returns filed for the 2019 calendar year the average federal tax refund for individuals was 2707. In the United States the average single worker faced a net average tax rate of 224 in 2020 compared with the OECD average of 248. Web Based on our estimates using the 2017 tax brackets a single person making 30000 per year will get a refund of 1556.

Check out how much he could. This is based on the standard deduction of 6350 and a. Web A single person making 50000 will receive an average refund of 2593 based on the standard deductions and a straightforward 50000 salary.

What is the average tax return for a single person making 65000. Web What is the average tax rate. Web The average tax return for the 2020 tax year was 2827 a 1324 percent increase from the previous year.

Web John is a single 30-year-old with no dependents. Web Whats the average tax return for a single person 2020. Web According to the IRS in Fiscal Year 2016 the average individual income tax refund was about 3050.

The average tax return for the 2020 tax year was 2827 a 1324 percent increase from the previous year. Last year he made 75000 withheld 15000 and collected no government benefits. I hired them again and they did a great job with that too.

If you make 65000 a year living in the region. Web Tax rate Single filers Married filing jointly Married filing separately Head of household. Review real professional profiles see prior experience and compare prices in one place.

Note that this does not include refunds in categories such as. Ad They did an excellent job. Ad Plan Ahead For This Years Tax Return.

Web The table below details how Federal Income Tax is calculated in 2022.

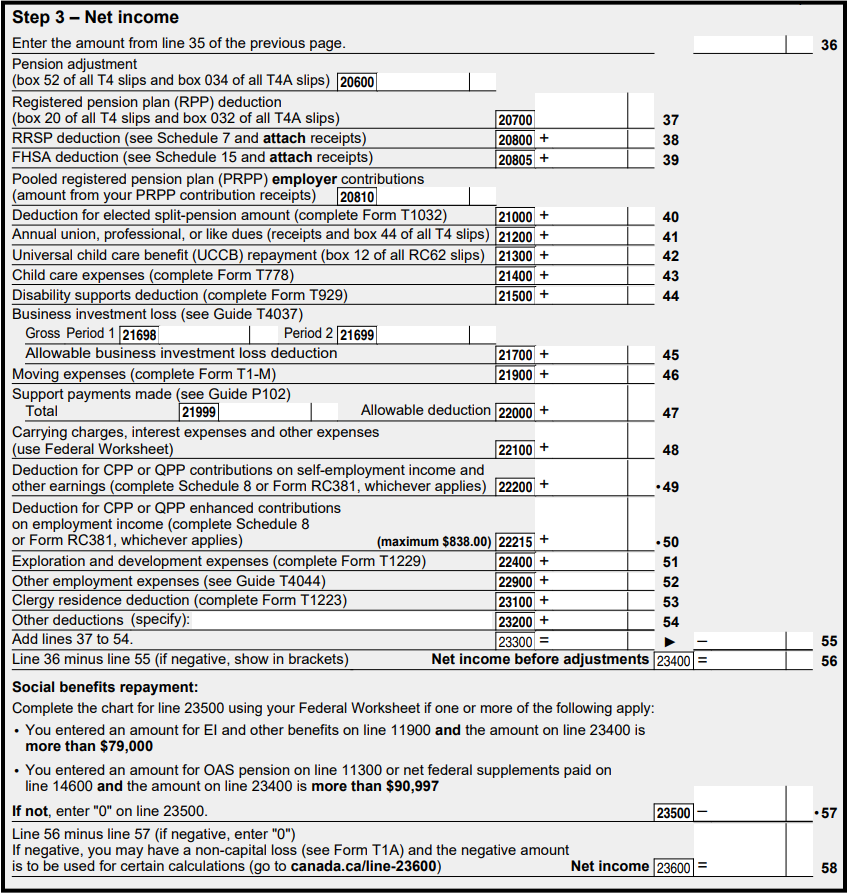

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Refundable Tax Credits And Negative Effective Rates Charts And Graphs Tax Credits Graphing

Here Is How The Federal Interest Price Can Help Save The Economic Climate During A Recession Tax Refund Interest Rates Check And Balance

Irs Form 433 B Oic Collection Information Statement For Businesses Visit Our Website To Download The Rest Of The Form Htt Irs Forms Sole Proprietorship Irs

The Majority Of Middle Income Tax Returns Are Single Filers Today Income Tax Return Charts And Graphs Income Tax

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Tax Schedule

The Majority Of Middle Income Tax Returns Are Single Filers Today Income Tax Return Charts And Graphs Income Tax

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

When You Get To The End Of March There Are A Bunch Of Tax Forms That You Should Have From People Do You Ha Personal Finance Budget Personal Finance Tax Forms

Taxes Can Be Very Complex And Smallbusinesses Often Run Into Difficulties When It Comes To Knowing All That They Nee Tax Time Payroll Taxes Business Expense

Do I Need To File A Tax Return Forbes Advisor

Rental Property Income Expense Tracker 5 Unit Single Family For Year End Tax Filing For Landlords Property Managers Digital Download Being A Landlord Rental Property Management Rental Income